[ad_1]

While there were several positive aspects of the budget, a question has been raised: Has studying abroad become more expensive with the new budget? Let’s take a look.

Higher Education in India

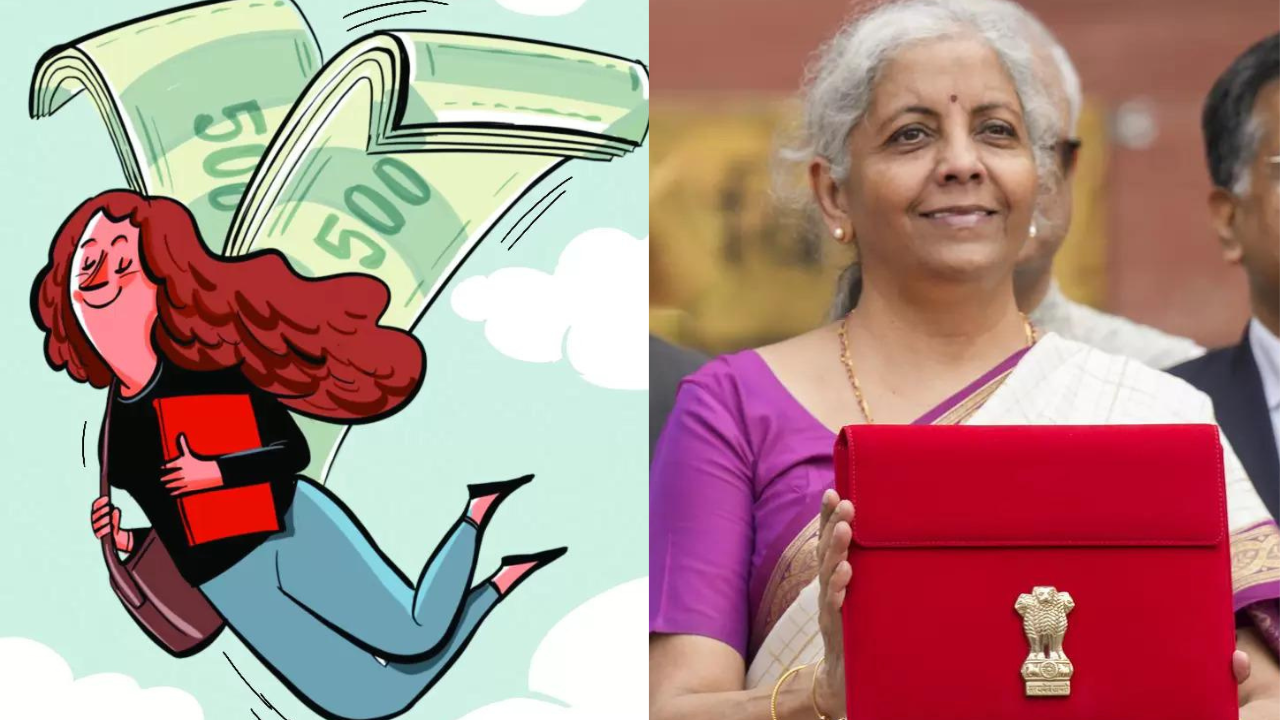

During her Budget 2024 speech, the finance minister announced that the government will offer financial assistance of up to Rs 10 lakh for higher education in domestic institutions. This support will be provided through e-vouchers, which will be directly given to one lakh students annually, along with an interest subsidy of 3 percent of the loan amount.

This can be seen as good news for students who want to pursue higher education in India. Additionally, youths not covered by any benefits under government schemes and policies will be eligible for this financial assistance. The government will issue e-vouchers to one lakh students every year, offering an interest subvention of three percent of the loan amount. This will lower the interest rates on education loans and ultimately reduce the financial burdens on students and parents.

For the fiscal year 2024-25, higher education has been allocated Rs 47,619 crore, reflecting a 7.68 percent increase from the Rs 44,094 crore budget estimate of 2023-24. However, this amount is lower compared to the revised estimate of Rs 57,244 crore for the same period.

Studying Abroad and the burden of TCS

While Sitharaman’s budgetary allocation for domestic higher education has been appreciated as a welcome move, let’s take a look at what she has to offer for those who want to pursue their higher education abroad? Well, the new budget has made overseas spending more taxing, including that on foreign education. During her speech, the finance minister announced changes in the Tax Collection at Source (TCS) provisions. But what does this have to do with studying abroad?

Before we move further, let’s understand what TCS is. TCS, or Tax Collection at Source, is a tax payable by sellers which they collect from the buyers at the time of sale of goods. Now, in the recent budget presentation, it is expected that the TCS requirement will add a financial burden at the time of remittance. According to the Budget proposal, credit for TCS will now be available against TDS deducted by the employer on salary income, which can help ease cash flow for employees. Further, if the TCS paid exceeds the actual tax liability, the excess amount will be refunded.

Well, if we take up the case for studying abroad, this is what it translates to. If a student’s international education is financed by a loan taken from a financial institution, the TCS rate will be nil up to Rs 7 lakh. However, if the costs exceed Rs 7 lakh, the rate will be 0.5%. For students who self-finance their study abroad costs, the TCS rate will be nil up to Rs 7 lakh, but above Rs 7 lakh, it will be 5%.

For example, suppose your overall spending in a year for studying abroad is Rs 10 lakh. In that case, the TCS collection will be done on the Rs 3 lakh at 0.5% or 5%, depending on whether you have taken a loan or are self-financed.

Now, has it become expensive? Well, the answer is yes if you are self-financing your education.

[ad_2]

Source link